20160318 WEEKLY WRAP IN TRADER'S MAZE

-- WEEKLY NEWS AS SEEN ON NET

Energy sector defaults could go like dominoes - MarketWatch

http://www.marketwatch.com/story/energy-sector-defaults-could-go-like-dominos-2016-03-16

-- OIL Slide possible impact on Stocks

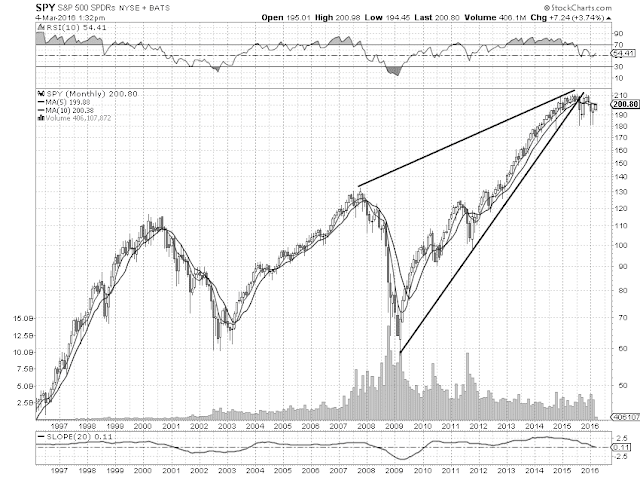

20160311 This is 'judgment day' for stocks: Technicianhttp://www.cnbc.com/2016/03/11/this-is-judgment-day-for-stocks-technician.html

-- and the result was above all bearish expectations

Goldman Warns Its Clients They Are Overlooking "The Largest Macro Market Risk" | Zero Hedge

http://www.zerohedge.com/...goldman-warns-its-clients-they-are-overlooking-largest-macro-market-risk

http://www.zerohedge.com/...goldman-warns-its-clients-they-are-overlooking-largest-macro-market-risk